Dubai Company Expert Services for Dummies

Table of ContentsThe smart Trick of Dubai Company Expert Services That Nobody is Talking AboutDubai Company Expert Services for DummiesGetting My Dubai Company Expert Services To WorkThe Single Strategy To Use For Dubai Company Expert ServicesAll About Dubai Company Expert Services

As the little boy stated when he obtained off his initial roller-coaster flight, "I like the ups but not the downs!" Here are several of the risks you run if you wish to begin a local business: Financial threat. The funds needed to begin and expand a company can be comprehensive.Individuals usually start companies so that they'll have even more time to spend with their households. Running a service is very taxing.

6 "The Entrepreneur's Workweek" (Dubai Company Expert Services). Vacations will certainly be difficult to take and will commonly be disturbed. In recent times, the trouble of getting away from the job has been intensified by cell phones, i, Phones, Internet-connected laptop computers as well as i, Pads, and numerous small organization proprietors have involved regret that they're constantly reachable.

Some people recognize from a very early age they were implied to own their own organization. Others discover themselves starting an organization because of life adjustments (being a parent, retirement, shedding a job, and so on). Others may be employed, but are questioning whether the role of business owner/entrepreneur is best for them. There are a number of advantages to beginning a service, but there are also risks that ought to be assessed.

3 Easy Facts About Dubai Company Expert Services Described

For others, it may be overcoming the unknown as well as striking out on their own. You define individual satisfaction, starting a new company might hold that assurance for you. Whether you watch beginning a business as an economic need or a means to make some additional earnings, you may discover it produces a new income.

Have you reviewed the competition and thought about how your specific company will be successful? Describe your service objectives. What do you want to accomplish and what will you take into consideration a success? Another big choice a local business proprietor faces is whether to have the company personally (sole proprietorship) or to develop a different, legal business entity.

An advantage corporation is for those local business owner who wish to earn a profit, while likewise serving a philanthropic or socially beneficial mission. You can create your service entity in any type of state but proprietors typically pick: the state where the service is located, or a state with a preferred controling statute.

The entity can be a separate taxed entity, indicating it will pay income taxes on its own tax obligation return. The entity can be a pass-through entity, suggesting the entity does not pay the taxes yet its income passes via to its owner(s).

Little Known Facts About Dubai Company Expert Services.

Sole investors and partners in a collaboration pay around 20% to 45% earnings tax while companies pay company tax, generally at 19%. As long as company tax obligation rates are lower than earnings tax obligation rates the benefit will often be with a limited firm. As well as salary repayments to employees, a company can likewise pay dividends to its shareholders.

Provided a minimum level of wage is taken, the supervisor retains entitlement to particular State benefits with no staff member or company National Insurance Contributions being payable. The equilibrium of remuneration is sometimes taken as dividends, which might suffer much less tax than wage as well as which are not themselves subject to National Insurance coverage Contributions.

This could be useful when the withdrawal of further income this year would certainly take you right into a greater tax bracket. You ought to always take professional tax obligation or monetary guidance in the light of your specific conditions, and also this area is no exception. No suggestions is used here.

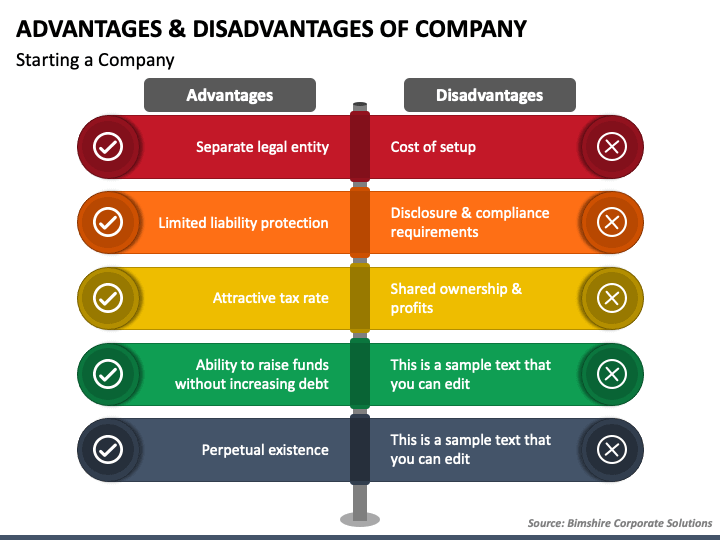

The most usual kinds of companies are C-corps (double tired) and also S-corps (not dual tired). Advantages of a corporation consist of individual responsibility defense, business safety and security as well as connection, as well as easier accessibility to capital. Disadvantages of a firm include it being time-consuming and also subject to double tax, along with having inflexible formalities as well as protocols to adhere to.

Facts About Dubai Company Expert Services Uncovered

One option is to structure as a company. There are a number of factors why including can be useful to your organization, there are a few downsides to be mindful of. To help you figure out if a firm is the very best legal structure for your company, we talked to legal experts to break down the different types of corporations, and the benefits as well as disadvantages of including.

For many businesses, these demands include producing corporate laws and filing write-ups of consolidation with the secretary of state. Preparing all the information to file your posts of unification can take weeks or perhaps months, however as quickly as you have actually effectively submitted them with your secretary of state, your business is formally acknowledged as a firm.

Firms are usually controlled by a board of directors elected by the why not look here investors."Each shareholder generally obtains one vote per share in choosing the supervisors," stated Almes. "The board of directors supervises the management of the daily operations of the company, as well as usually do so by employing a monitoring group."Each owner of the corporation generally owns a percent of the business based upon the number of shares they hold.

A company offers much more individual asset liability defense to its owners than any other entity type. If a company is taken legal action against, the investors are not directly responsible for corporate financial debts or legal obligations also if the corporation does not have enough cash in assets for payment. Personal obligation protection is among the major reasons companies choose to incorporate.

Fascination About Dubai Company Expert Services

This access to funding is a deluxe that entity kinds do not have. It is great not just for expanding an organization, yet additionally for conserving a company from declaring bankruptcy in times of demand. Although some corporations (C companies) undergo dual taxation, other firm structures (S companies) have tax advantages, depending upon just how their earnings is distributed.

Any kind of earnings designated as proprietor wage will certainly go through self-employment tax obligation, whereas the remainder of the service returns will certainly be exhausted at its very own level (no why not try here self-employment tax). A company is except every person, as well as it might end up costing you even more time as well as cash than it deserves. Before ending up being a firm, you ought to be mindful of these prospective disadvantages: There is a prolonged application procedure, you must adhere to stiff formalities and also procedures, it can be pricey, and also you might be dual exhausted (depending upon your company structure).

You have to comply with lots of procedures and also hefty guidelines to keep your company standing. As an example, you require to follow your laws, preserve a board of directors, hold yearly conferences, maintain board mins and also produce yearly records. There are also constraints on specific corporation kinds (as an example, S-corps can only have up to 100 check over here investors, who must all be united state. There are several kinds of firms, including C corporations, S corporations, B firms, shut firms and also not-for-profit corporations. Each has it benefits and also negative aspects. Some options to corporations are single proprietorships, partnerships, LLCs and cooperatives. As one of one of the most typical kinds of corporations, a C corporation (C-corp) can have a limitless number of investors and is tired on its earnings as a different entity.